Bhubaneswar: After being pinned down by the Covid-19 virus, the Indian economy has recovered its spine only in late 2022. But there is a growing concern that Indian Economy is again on the verge of slowdown. The job scenario in the country has worsened.

The State bank of India report has recently sounded the economic slowdown alert when it stated, “India story appears to take a brief pause, some kind of unexpected hiatus, with economy (real GDP) growing by a mere 5.4% in Q2 FY25, chiefly dented by sluggish growth in industry.”

The report flagged, “Industry decelerated to 6-quarters low to 3.6% in Q2 due to broad based sluggishness.”

WHY JOB LOSS?

It needs mentioning is during Covid-19, the Annual Survey of Industries data shows job losses in manufacturing sector stood at 5.3 crore. Post Covid-19, in year 2022, the manufacturing industrial sector had added over 11 lakh jobs. In 2023-24, the country’s manufacturing sector has added another 40 lakh jobs.

As per SBI report following dip in industrial parameters risks job losses in India again.

- In actual rupee terms the incremental growth in industry comes to merely Rs 42,515 crore in Q2 FY25 over Q2 FY24 as compared to whopping Rs 1.4 lakh crore growth in preceding corresponding period,

- indicating a hit of almost Rs 1 lakh crore in incremental terms in overall industry.

- Around 4000 Corporates reported revenue growth of only 6.13%

- while EBIDTA(earnings before interest, taxes, depreciation, and amortization) and profit after tax (PAT) growth of around 7% and 9.4% respectively in Q2FY25 as compared to Q2FY24.

- However, excluding-BFSI (banking, financial services and Insurance), corporates reported negative EBIDTA growth of around 1.5% in Q2FY25 as compared to 41% growth in Q2FY24. Major sector that contributed to the negative growth of 1.5% in EBIDTA in Q2FY25

- The negative growth is seen in Refineries, Cement, Power Generation and Distribution, Paints/Varnish, Tyres, Air Transport, Paper, Textile etc.

- Major sectors like Automobile, Cement, Power Generation and Distribution, Tyres etc. reporting lower to negative EBIDTA growth in Q2FY25 as compared to impressive double-digit growth in Q2FY24.

- The report also mentions of employee expenses growing positively.

- This mismatch sounds the red blip on possible job losses.

WHY INDSUTRIAL SLOWDOWN – RBI REPORT REVEALS BIG!

With the centre having appointed Sanjay Malhotra as the new governor of the country’s central bank – Reserve Bank of India, the Minutes of the Monetary Policy Committee report released by RBI tells a big tale.

The Minutes of Monetary Policy Report released Friday by the RBI has put a stamp of approval of the SBI report that ‘India story’ is heading towards a growth downhill. First take a look at the table given below.

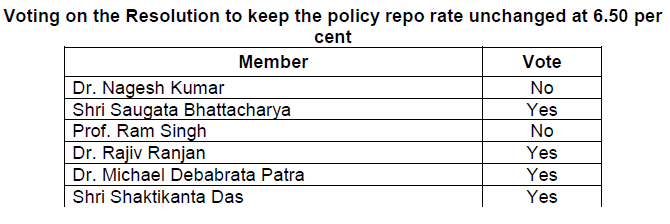

The table shows the of the 6-membered MPC body, the voting on keeping the repo rate unchanged passed by 4-2 votes – meaning 4 in support and 2 in against. On Dec 4, the repo rate was kept at 6.5% by the RBI

However, the two members – Dr Nagesh Kumar and Prof Ram Singh, who have voted against the policy of ‘No Repo rate cut’, in their notings have noted that India is heading towards economic slowdown, triggered by industrial slowdown, and a 25bp repo rate cut is urgently needed.

Here is what the 2 distinguished economists have said.

DR NAGESH KUMAR

- Decline in the Q2 2024-25 growth numbers from 8.2% achieved in 2023-24 and from 6.7% on Q1 2024-25 to just 5.4% is much sharper than expected.

- The slowdown has led to the downgrading of the GDP growth forecasts for 2024-25 by most analysts from around 7% earlier to around 6.5% now.

- The extent of the slowdown is serious enough to warrant policy attention.

- The slowdown largely reflects the weakness of the industrial sector.

- The growth rate of industrial value added has decelerated sharply from 7.4% in Q1 to only 2.1% in Q2.

- All the subsectors of the industry, namely mining, manufacturing and electricity, have decelerated.

- What is most worrying is the deceleration of growth of manufacturing value added from 7.0% to 2.2%.

- The corporate performance indicators corroborate the deceleration of manufacturing growth.

- The sales growth of manufacturing companies has moderated from 6.2% in Q1 to 3.3% in Q2.

- In particular, negative growth rates in iron & steel and cement are worrying.

- The listed private non-financial corporate performance results also suggest that manufacturing GVA growth decelerated from 11.7% (y-o-y) in Q1 to 5.0% in Q2

- As a result of the slowdown of industrial activity, the employment sentiment deteriorated in Q2.

- Slowdown of the manufacturing sector can be addressed by bringing down the cost of capital, which may stimulate investments as well as consumer demand.

- Hence, a rate cut could help, among other measures.

- Expanding the manufacturing sector could also help in containing inflationary pressures by enhancing the supply capacity.

- Most central banks around the world, barring a few, have embarked on an easing cycle in recent months, with some, like the US Fed, adopting a rather aggressive posture towards cutting the policy rates.

- India risks currency appreciation if we do not follow the process of normalisation when most others have moved forward.

- The rupee has already been appreciating in real terms, and a further appreciation would hurt the competitiveness of Indian products.

- Therefore, I believe that a rate cut would help in reviving economic growth without worsening the inflationary situation, which may soften with seasonal correction in prices.

PROF RAM SINGH

- The GDP growth rate has hit a seven-quarter low of 5.4% in Q2 amid a manufacturing slump and deceleration in private consumption and investment.

- The GVA (gross value added), a critical indicator of economic activity, also came at 5.6 per cent in Q2.

- Accordingly, the RBI has lowered the GDP growth forecast to 6.6 per cent, down significantly from earlier projections of 7.2 per cent.

- The MPC's mandate is to ensure price stability while supporting growth. The present situation of significantly slower growth without material changes in the prospects for inflation requires shifting the pivot of monetary policy to a counter-cyclical mode.

- The empirical relation between the core inflation and GDP growth rate (actual and potential) is well established.

- A persistent decrease in the core inflation during the last 7-8 quarters, combined with the slowdown in growth rate, suggests that the difference between the actual and potential growth rate is increasing.

- These observations and the fact that the labour market is not tight mean that the economy can grow significantly faster without triggering inflation.

- For the above reasons, I vote to reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 6.25 per cent. And maintain the monetary policy stance to ‘neutral’.

BOTTOMLINE: The Minutes report released by RBI where 2 members of the MPC raised the concern of slowing economy and worsening job market, which was also supported by SBI report, hints at why the Modi government has gone for appointment of new RBI governor.