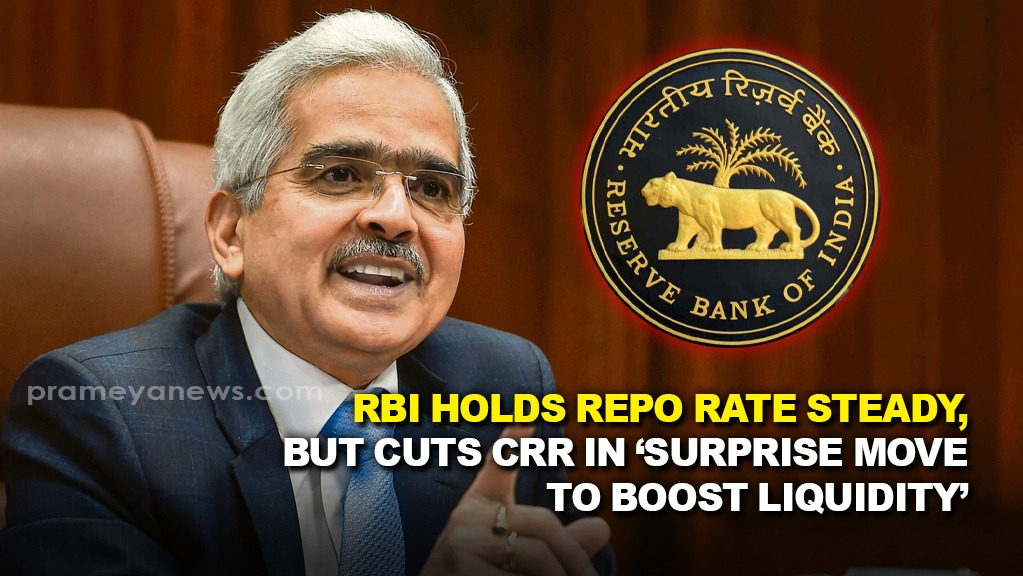

In a widely anticipated monetary policy announcement, the Reserve Bank of India (RBI) opted to maintain the status quo on the benchmark repo rate, keeping it unchanged at 6.5%. However, in a surprise move, the central bank announced a 50 basis point reduction in the cash reserve ratio (CRR) to 4%, effective in two tranches on December 14th and December 28th. This decision reflects the RBI's delicate balancing act between supporting economic growth, which has slowed to a seven-quarter low, and keeping inflation in check.

Key Takeaways from the RBI's Monetary Policy Committee (MPC) Meeting:

- Repo Rate Unchanged: The MPC voted 4-2 to keep the repo rate unchanged at 6.5%, citing concerns about persistent inflation.

- Neutral Stance: The RBI retained its "neutral" policy stance, indicating its willingness to adjust rates in either direction depending on evolving economic conditions.

- CRR Cut: The CRR, which is the percentage of deposits that banks must hold with the RBI, has been reduced from 4.5% to 4%. This move is expected to inject Rs 1.16 lakh crore into the banking system, easing liquidity constraints.

- GDP Growth Forecast Revised: The RBI revised its GDP growth forecast for FY25 to 6.6% from 7.2%, acknowledging the recent slowdown in economic activity.

- Inflation Projection: CPI inflation for 2024-25 is projected at 4.8%, with risks evenly balanced.

- Focus on Price Stability: RBI Governor Shaktikanta Das emphasized the importance of price stability for sustained economic growth.

- Measures to Boost Capital Inflows: The RBI raised the interest rate ceiling for banks for foreign currency non-resident (FCNR-B) deposits to attract capital inflows.

- Other Initiatives: The RBI announced several other initiatives, including expanding the FX-Retail platform, introducing a new secured overnight rupee rate benchmark, and setting up a committee of experts to suggest a framework for the responsible and ethical use of AI.

- Increased Collateral-Free Agriculture Loan Limit: The limit for collateral-free agriculture loans has been increased from Rs 1.6 lakh to Rs 2 lakh per borrower to enhance credit availability for small and marginal farmers.

Expert Opinions:

- Anil Rego, Founder and Fund Manager at Right Horizons PMS: Anticipates rate cuts at the end of FY25 or beginning of FY26 due to intensified inflation. Expects NBFCs and credit-sensitive sectors like auto and real estate to benefit from rate cuts.

- Divam Sharma, Founder and Fund Manager at Green Portfolio: Views the CRR reduction as a positive move that will boost liquidity in the banking system. Expresses confidence in the stability of the financial system and the RBI's proactive approach.

- Anirudh Garg, Partner and Fund Manager at Invasset PMS: Sees the projected GDP growth of 6.6% for FY25 as a sign of underlying economic strength. Believes the RBI's neutral stance provides stability and encourages fund managers to focus on sectors poised to benefit from sustained domestic demand.

The RBI's decision to hold the repo rate steady while cutting the CRR reflects a cautious approach to monetary policy in the face of slowing growth and persistent inflation. The CRR cut is expected to provide a much-needed boost to liquidity in the banking system, supporting credit growth and economic activity. The RBI's focus on price stability and its various initiatives to strengthen the financial system and promote responsible innovation underscore its commitment to maintaining a stable and sustainable economic environment. The market's reaction to the RBI's policy announcement and the effectiveness of the CRR cut in stimulating growth will be closely watched in the coming months.

DISCLAIMER: This brief is based on information from publicly available sources and reflects the author's interpretation of the topic and do not reflect Prameya's or Prameya News7 editorial stance.