Bhubaneswar: Odisha has come in for praise by none other the country’s central bank – the Reserve Bank of India. It has raised a toast to the State for what it called – Transformative Fiscal Management. The Central Bank has also traced to why development of social and physical infra growth took time to take off in the State.

The Reserve Bank of India has reportedly gone gaga over the State’s prudent fiscal management by the Naveen Patnaik led government since the year 2005. The RBI lauded State for taking a leap to top from bottom. The bank has listed the State’s achievements in prudent fiscal management that deserves a big hand.

ZERO TO HERO

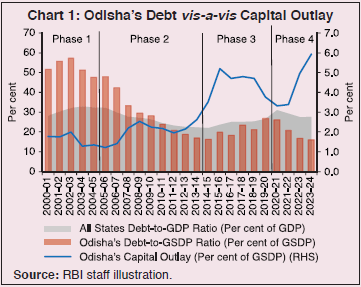

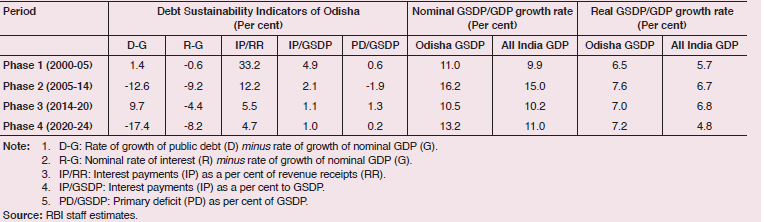

As per the RBI report Odisha was one of the most fiscally stressed States in the early 2000s, with a debt-GSDP ratio of 57.3 per cent in 2002-03 – well above the consolidated debt-GDP ratio of 32.1 per cent for all States. Also,

- Interest payments to revenue receipts ratio (IP/RR) was 34.2 per cent in 2002-03, that had imposed a significant strain on the State’s finances.

- But in 2023-24, the debt-GSDP ratio was at mere 16% - the lowest among the Indian states. View the Chart

HOW THE MIRACLE HAPPENED?

The RBI report says the miracle is not all about abracadabra…

But a consolidation journey started by the State, which the Central bank traced through dividing it into four phases – each characterised by specific strategies and outcomes aimed at improving its financial condition and ensuring development.

Phase 1: 2000-01 to 2004-05 (High Debt Era)

The Naveen Patnik led BJD-BJP government stormed to power seat in Odisha in year 2000. The economy of the State during the first tenure has been very precarious. RBI listed the following chinks in fiscal armour of the State.

- During the pre-reform phase, in the absence of a rulebased fiscal policy, the State’s finances deteriorated sharply on account of rapid increases in salary and pensions,

- negative contributions from public sector undertakings,

- high subsidies, and

- poor recovery of loans and advances.

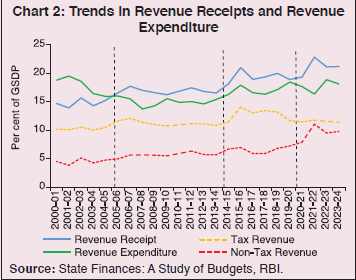

THE RESULT: Revenue expenditure often exceeded revenue receipts (Chart 2).

The public debt of Odisha increased at a higher rate than its GSDP, violating the condition of debt sustainability (Table below).

Phase 2: 2005-06 to 2013-14 (Debt Consolidation through Rule-based Fiscal Policy)

In the second tenure of the coalition govt, Odisha saw enactment of the Odisha Fiscal Responsibility and Budget Management Act (OFRBMA) in 2005. State first chugged on to the journey of REVENUE SURPLUS.

But know why DEVELOPMENT was not visible till YEAR 2014 – RBI gives the Reason HERE.

- Year 2005 marked a turning point for the State’s finances. Crucial tax reforms like the

- Introduction of VAT, rationalisation of tax rates,

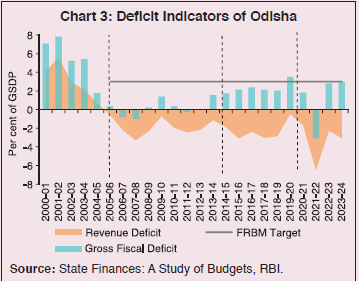

- broadening the tax base, enhancing enforcement, and

- use of IT-based tools in tax administration improved compliance and contributed to the revenue surplus witnessed since 2005-06 till date (Chart 3).

- During this phase, the debt position of the State turned sustainable, and the IP/RR ratio declined below the limit of 15 per cent placed by OFRBMA.

- BUT Fiscal consolidation during this phase was achieved through a reduction in government expenditure, with developmental capital expenditure hovering at just around 2 per cent of GSDP.

- The reduced share of developmental capital expenditure had been behind the slow DEVELOPMENT till year 2014.

Phase 3: 2014-15 to 2019-20 – DEVELOPMENT STARTED IN ODISHA

- During this phase the State’s Revenue receipts moved upwards, with gains in both tax and non-tax sources (Chart 2).

- While the revenue account remained in surplus, the capital outlay of the State increased sharply during this phase mainly financed through higher borrowing (Chart 1).

- Higher capital expenditure resulted in kick-starting of the Development (of social and physical infrastructure) of the State.

GAME CHANGER Phase 4: 2020-21 ONWARD (COVID-19 TO PRESENT TIME)

As per RBI, the sound fiscal reforms undertaken by the State since 2005 had borne fruits after a decade and half.

Even during the challenging times of COVID-19, Odisha maintained prudent fiscal practices like periodic revision of the rates/user charges of various tax and non-tax sources and monthly reviews of revenue collection.

- Odisha is the only State to register a revenue surplus (1.7 per cent of GSDP) during the pandemic year of 2020-21,

- Which increased to 6.5 per cent of GSDP in 2021-22 on account of higher realisation of non-tax revenue.

- Odisha’s non-tax revenue is steadily increasing, reflecting higher revenues from mining leases, with premiums linked to market prices over the lease period, rather than increased extraction.

- Enlarged fiscal space has enabled the State to undertake expenditure in critical sectors of the economy such as

- infrastructure development,

- incentivising MSMEs and companies for industrial cluster development across the State

- Notably, the strong capex (capital expenditure) thrust observed during this period was accompanied by a steady decline in the debt level.

THE RESULT: A lower than targeted debt-to-GSDP ratio (16%) mandated under the FRBM Act (25%), provided the State government the elbow room to step up its capital spending to support higher growth.