Bhubaneswar: The upcoming Union Budget 2025 will be presented by Finance Minister Nirmala Sitharaman on February 1. The expectations are high that the FM will go for some big changes on the personal tax front.

While people expecting a slash in income tax rates and a raise in the basic exemption limit, the revenue losses the Union Government may accrue due to reduction in tax rates or exemptions may keep the Finance Minister from going gung ho over rolling out big tax rate cuts or wholesale exemptions.

WHY?

It needs mentioning that Income tax is a major sources of revenue for the Union government.

As per CBDT, Income tax collections saw a notable increase in 2024, which is a reflection of the strengthening of the tax base, improved compliance, and growing economy.

The data released by the CBDT shows Personal Income Tax collections for FY 2024-25 as on November 10, 2024 stood at Rs 8,03,491 Crore, which has been over 53% of the total direct tax collections of the Union govt.

Moreover, the Personal income tax (PIT) collections have now surged higher than corporate tax collections since the FY21, and personal income tax is accounting for 7% of Union government's revenue receipts..

Given its lion’s share in direct tax collections, and a significant share in revenue receipts, it will not be easy for the FM to entail high revenue loss via more exemptions or tax rate cuts.

So then?

FM MAY GO FOR MINIMAL HIT

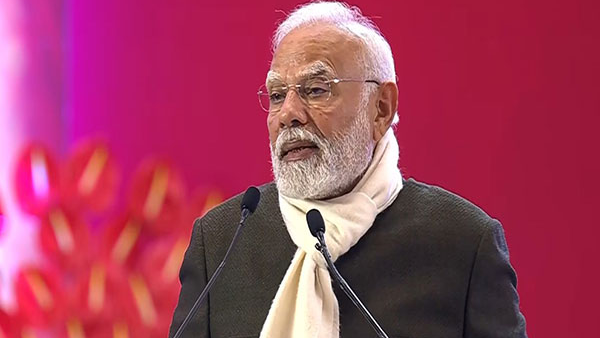

As per SBI chief Economic Advisor Dr Soumya Kanti Ghosh, the Union Budget may likely to go for following relief in personal income tax, as it entails minimum loss of revenue to the centre.

- Finance Minister Nirmala Sitharaman may keep the peak rate of 30 percent for income above 15 lakhs intact.

- But tax rates may be reduced to 15% for the Rs 10 lakhs-Rs 15 lakhs bracket

- FM may remove all exemptions except healthcare and NPS are retained.

- The FM may hike the exemptions under healthcare to Rs 50,000 from Rs 25000

- Exemptions under NPS may be hiked to R 1 Lakh from present Rs 75 k.

- FM may impose a flat 15% tax on bank deposits

- FM may increase the limit of tax exemption on Saving Account deposits to Rs 20,000.

- The measures will see a revenue loss of Rs 50000cr to the government, which is a meager 0.14% of GDP.

BUDGET MAY SEE RATIONALISATION OF INDIRECT TAXES

Since nation’s economic growth is being boosted by consumption, and when indirect taxes have a much greater role in booting consumption than direct taxes, Union Finance Minsiter may go for rationalisation of taxes on indirect taxes to give a fillip to consumption.

SBI BATS FOR GST 2.0

As per the SBI report, the Budget should lay a roadmap for GST 2.0. It says:

“Need for second round of reforms in GST with the rationalization of tax rates and inclusion of electricity tariff → then Aviation turbine fuel → and finally Petrol/Diesel. Exempting / Lowering health insurance products from GST at least for all retail and health focused products”