Bhubaneswar: With the BJP facing middle class, especially salaried class, detachment which is evidenced in a fall in voter turnout rates in key states during the 2024 Lok Sabha polls, Union Finance Minister Nirmala Sitharaman is expected to don Santa Claus cap this budget.

Moreover, when the recently released National Statistics Office (NSO) data on GDP that showed how the consumers are boosting the economic growth in the country, despite slowing down of vital sectors – industry and services, in economical sense, the FM may give tax sops to boost the private consumption to keep the economy wheels running fast.

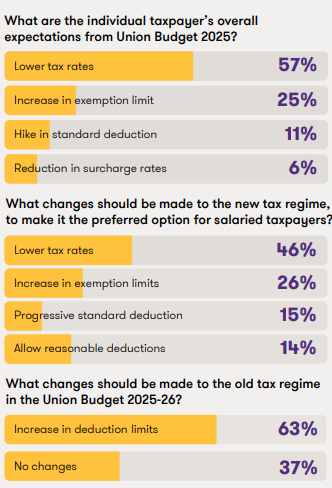

The mood of the middle class has been captured by a pre budget survey done by Grant Thornton Bharat. As per the GTB survey a whopping 57% yearn for lower tax rate with 25% advocating higher exemption limit. Here are the survey results given below.

In the above backdrop, Bank of Baroda economist Sonal Badhan predicts the following changes the Budget 2025-26 in the realm of Income Tax.

- To lighten the burden of consumers due to high inflation in recent years, government may increase limit under standard deductions.

- Savings under section 80C can be increased from Rs 1.5 lakh to Rs 2.5 lakh.

- Limit for additional savings under pension contribution may also be hiked.

- Savings under 80D for health insurance premiums can be hiked from Rs 25,000 to Rs 50,000

- Life insurance premiums can also be included under 80D exemption, to increase penetration.

- In order to attract more tax payers to adopt the new tax regime, tax rate can be reduced for under Rs 15 lakh income bracket.

A glance at the above predictions, the following conclusions are likely.

- FM has left the basic exemption limit untouched last Budget

- Amidst high inflation, Finance Minister may raise the basic exemption limit to Rs 5 lakhs

- Moreover, the standard deductions that has been at Rs 75000 in the new tax regime, may give a push up to take it to Rs 1 lakh

- Thus, making 0% tax payable upto Rs 6 Lakh income.

- Moreover, a 5% tax rate may be levied on income above Rs 6 lakh to Rs 10 lakh.

WHAT E&Y SEES COMING IN IT RATES?

As per the EY report, the tax regime under the FM Nirmala Sitharaman during the last 4-budgets had achieved the following.

- FM’s Concessional Tax Regime (CTR) proved beneficial for high income earners.

- This has reduced that maximum marginal rate from 42.74% to 39% over the last 4-years.

- But for the middle income earners – earning annual income of below Rs 15 lakh – haven’t reaped benefits on direct tax front.

- For which, it also see the following coming.

- Basic exemption limit rising to Rs 5 lakh from Rs 3 lakh

- A cut in tax rates to provide more disposable income at the hand of taxpayers.

WHAT PwC SAYS ON PERSONAL TAXES?

As per the analysis of Price waterhouse and Coopers, the Budget 2025-26 may see the new features on the personal tax front.

- Basic exemption limit will rise to Rs 5 lakh

- Budget 2025 would see the introduction of what will be arguably the most significant tax legislative change in more than 60 years with the presentation of the new Income Tax Act 2024 (the new act).