Bhubaneswar: Is the Indian economy heading to slowdown, when early signs of hMPV spread witnessed?

The final advance estimates on real GDP released by National Statistics office (NSO) don’t augur well when the hMPV cases in the country are showing an uptick.

The data released by NSO comes as a big dampener as the real GDP of the country is projected to grow less than the RBI forecast for FY25.

The RBI in its recently monetary policy meeting has downgraded the country’s real GDP growth to 6.6% from its earlier projection of 7.2% in 2024-25.

But the NSO first Advance Estimates (AE) estimates the real GDP of the country for the year 2024-25 at 6.4%

INDIAN ECONOMY SLOWING DOWN?

The perils of Indian economy slowing down looms large as the NSO data estimates a sharp fall in real Gross Value Added (GVA) to the economy, which shows the country is rolling into a slowdown phase.

As per the NSO data, the real GVA has grown by 6.4% in FY 2024-25, when the growth rate was 7.2% in FY 2023-24.

A look at the nominal GDP and GVA sounds the slowdown alerts.

- Nominal GDP (means inflation included) for 2024-25 estimated at 9.7%, marginally up over 9.6% in 2023-24.

- Also, the nominal GVA (means gross value added with inflation accounted) has been marginally higher at 9.3% in 2024-25 as against 8.5% in 2023-24.

- This marginal growth when the inflation in 2024-25 has remained above the RBI threshold inflation mark, and for which RBI is not letting a cut in the CRR, sounds the alarm of country slipping into slowdown era.

INDUSTRIAL SLOWDOWN PULLING ECONOMIC GROWTH: WILL IT LEAD TO JOB LOSS?

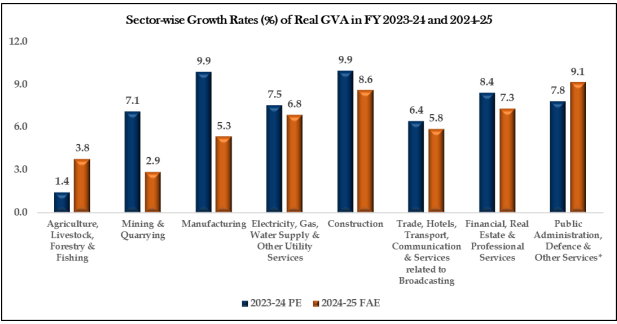

The sector wise GVA data released by NSO spills the beans. The industrial slowdown is effecting the growth story of India. (see the chart below)

. * Mining and quarrying GV sharply down to 2.9% from 7.1% in 2023-24

- Manufacturing sector shows sharp deceleration to 5.3% from 9.9%.

On the contrary, Agriculture sector growth has been smart with the real GVA clocking 3,8% growth vis-a-vis 1.4% in 2023-24.

SERVICES SECTOR NOT IN ROBUST PHASE

- Deceleration in real GVA measured in Construction, trade and hotels, financial and real estate and professional services.

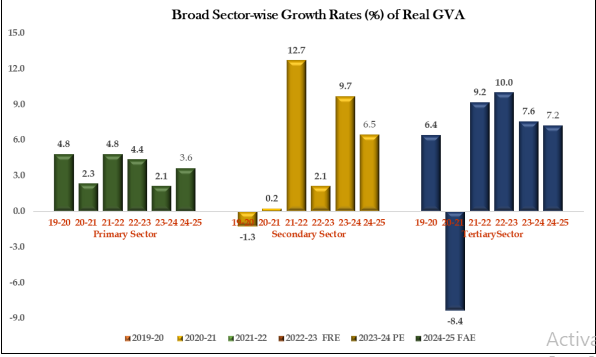

See the graph below. The graphs shows poor industrial growth in 2019-20 and 2020-21, and incidentally the years were in the grip of economic slowdown and job losses.

Since manufacturing and services sector provide 3 in every five jobs, the slower growth of real GVA sounds the concern of no private job openings in the Fiscal year 2025-26, and if the slowdown lingers job shedding may seem possible.

Now govt controlled sectors are doing well, which is evidenced by the growth in Public Administration and Defence services.

IS ALL GLOOM DOOM?

What looks assuring for the Indian economy has been the healthy growth of Private Final Consumption expenditure (PFCE), as per the NSO, the Private Final Consumption Expenditure (PFCE) at Constant Prices, has witnessed a growth rate of 7.3% during FY 2024-25 over the growth rate of 4.0% in the previous financial year.

The indicator sheds light on people’s purchasing power. The swift growth shows purchasing power has not eroded in the country.

The indicator shows India growth story is still breathing big

WILL HIGH PFCE GROWTH APPLY BRAKES On RBI CRR CUT?

The unchanged CRR policy is being currently blamed for slowdown in industrial sector. And RBI opted the hands off approach on account of high inflation.

With PFCE growth in 2024-25 more than 2023-24, will it dissuade RBI new Governor to go for CRR cut in April?

Time will tell!