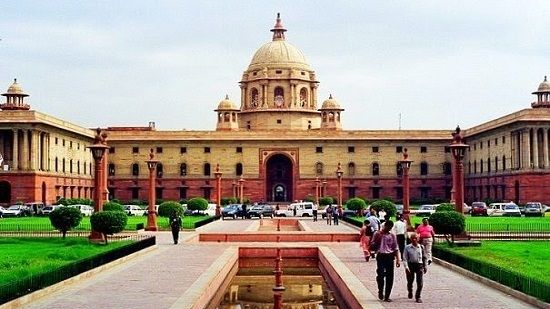

India's tax system is about to get a digital upgrade. Union Minister Ashwini Vaishnaw announced the launch of PAN 2.0, a revamped version of the Permanent Account Number (PAN) system that promises to revolutionize how taxpayers interact with the tax authorities. This ambitious initiative, part of the government's Digital India vision, aims to streamline processes, enhance security, and improve the overall taxpayer experience.

PAN, a unique 10-digit alphanumeric identifier issued to all taxpayers in India, has been in use since 1972. With over 78 crore PAN cards issued, covering 98% of individuals, the system has become an integral part of India's financial landscape. However, the existing PAN system, while robust in its reach, has faced challenges in keeping pace with the evolving digital needs of businesses and citizens. Issues like cumbersome application processes, vulnerability to fraud, and a lack of integration with other digital platforms have hindered its efficiency and user-friendliness.

PAN 2.0 seeks to address these challenges head-on by leveraging technology to create a more efficient, secure, and user-friendly system. The project, estimated to cost ₹1,435 crore, represents a significant investment in modernizing India's tax infrastructure. It will re-engineer business processes and transform PAN/TAN services through digital innovation, bringing them in line with global best practices and catering to the needs of a rapidly growing digital economy.

Key Features of PAN 2.0:

QR Code integration: The new PAN cards will feature QR codes, enabling quick and easy verification and reducing the risk of fraud. This simple yet effective addition will streamline verification processes for various financial transactions and interactions with government agencies, making compliance easier and faster.

Enhanced security: Stringent cybersecurity measures will be implemented to protect user data from cyber threats, ensuring the confidentiality and integrity of sensitive information. This includes robust encryption protocols, multi-factor authentication, and regular security audits to safeguard taxpayer data from unauthorized access and potential breaches.

Unified portal: A centralized online portal will provide access to all PAN-related services, streamlining processes and offering a seamless user experience. This portal will serve as a one-stop shop for taxpayers, allowing them to apply for new PAN cards, update their information, track their applications, and access various other services with ease.

Common business identifier: PAN will be integrated as a universal identifier for business-related activities across specified government agencies, simplifying compliance and promoting ease of doing business. This will reduce the need for multiple identifiers for different government interactions, making it easier for businesses to comply with regulations and focus on their core operations.

PAN data vault: Entities handling PAN data will be required to implement secure storage systems, ensuring the safety and confidentiality of taxpayer information. This will involve adhering to strict data protection standards and implementing robust security measures to prevent data breaches and misuse of sensitive information.

What to Expect from PAN 2.0:

Streamlined processes: Simplified procedures for PAN application, updates, and verification, reducing bureaucratic hurdles and saving time for taxpayers. This will involve minimizing paperwork, automating processes, and leveraging digital platforms to make interactions with the tax authorities more efficient and user-friendly.

Enhanced user experience: A user-friendly online portal and mobile app will provide easy access to PAN-related services, enabling taxpayers to manage their accounts with ease. This will empower taxpayers to access information, update their details, and complete transactions from the comfort of their homes or offices, reducing the need for physical visits to tax offices.

Improved grievance redressal: A technology-driven grievance redressal mechanism will ensure prompt resolution of taxpayer issues and enhance transparency. This will involve online complaint registration, automated tracking of complaints, and timely resolution through dedicated channels, ensuring that taxpayer concerns are addressed efficiently and effectively.

Digital integration: PAN will become a common identifier for various digital systems of government agencies, promoting interoperability and simplifying interactions. This will create a more cohesive digital ecosystem, allowing for seamless data sharing between different government departments and reducing the need for citizens to provide the same information repeatedly.

Benefits for Businesses and Individuals:

PAN 2.0 is expected to bring significant benefits to both businesses and individuals. For businesses, it will simplify tax compliance, reduce administrative burden, and promote ease of doing business. For individuals, it will streamline processes, enhance security, and provide a more user-friendly experience.

The introduction of QR codes will make it easier for businesses to verify the identity of their customers and clients, reducing the risk of fraud and ensuring compliance with KYC (Know Your Customer) norms. The unified portal will provide a single platform for businesses to manage all their PAN-related activities, from registration to updates and validations.

For individuals, PAN 2.0 will offer a more convenient and secure way to manage their tax affairs. The online portal and mobile app will provide easy access to various services, while the enhanced security measures will protect their sensitive information from cyber threats.

PAN 2.0 represents a significant step towards a fully digital financial ecosystem in India. By leveraging technology to enhance efficiency, security, and user experience, the government is creating a tax system that is more transparent, accessible, and citizen-centric. This initiative not only simplifies tax compliance but also strengthens data protection and promotes ease of doing business. As India embraces the digital age, PAN 2.0 is poised to become a cornerstone of the nation's financial infrastructure, empowering taxpayers and driving economic growth. It is a testament to the government's commitment to leveraging technology for the benefit of its citizens and building a more robust and inclusive digital economy.