By Sanjeev Kumar Patro

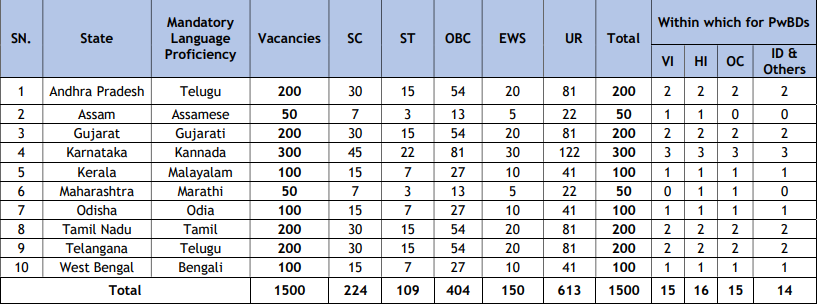

Union Bank of India, a leading listed Public Sector Bank with Central Office at Mumbai and a pan India presence, as well as, overseas presence, invites On-line Applications for recruitment of Local Bank Officers in JMGS-1. The leading public sector bank with over 8500 branches has notified a total of 1500 Local Bank Officer Vacancies. The last day for applying online is November 13 (13/11/2024).

STATE WISE VACANCIES: 100 vacancies in Odisha.

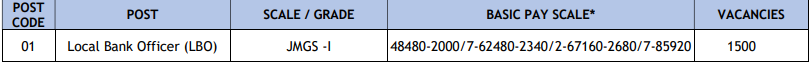

SALARY AND PERKS

The basic salary of Union Bank of India’s Local Bank Officer is Rs 48, 480. The detailed pay structure is given below. The bank notifies that in addition, Special Allowance, Dearness Allowance and other allowances will be payable as per prevailing rules and regulations in the Bank. Further, the officer will also be eligible for amenities like residential quarters/lease rent in lieu of quarters, LFC, reimbursement of medical/hospitalization expenses and other perquisites as per the policy of the Bank.

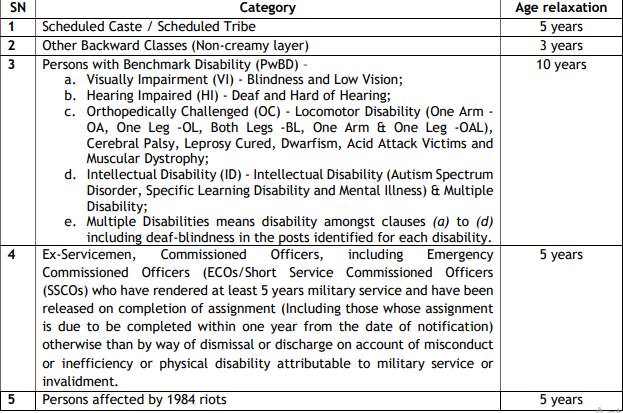

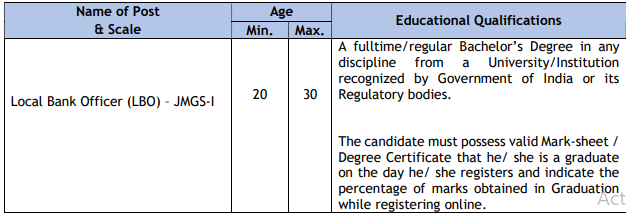

AGE AND ELIGIBILITY CRITERIA

The appicant should be minimum 20 years age and maximum 30 years. Age relaxation has been announced for various categories. detailed in the table below.

A fulltime/regular Bachelor’s Degree in any discipline from a University/Institution recognized by Government of India or its Regulatory bodies.

The candidate must possess valid Mark-sheet / Degree Certificate that he/ she is a graduate on the day he/ she registers and indicate the percentage of marks obtained in Graduation while registering online.

Application can be made only for any one of the States as per identified vacancies in this Notification and the applicants intending to apply should ensure that they fulfill the eligibility criteria specified. Proficiency in language of the State applied is required.

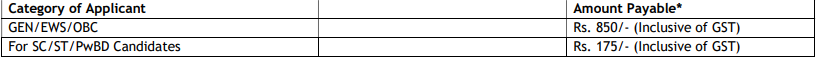

APPLICATION FEE

The details of aplication fee in each categories given below.

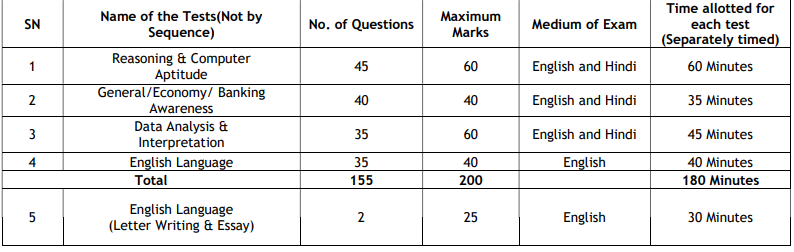

EXAMINATION STRUCTURE: The online examination consists of the following structure.

EXAMINATION STRUCTURE: The online examination consists of the following structure.

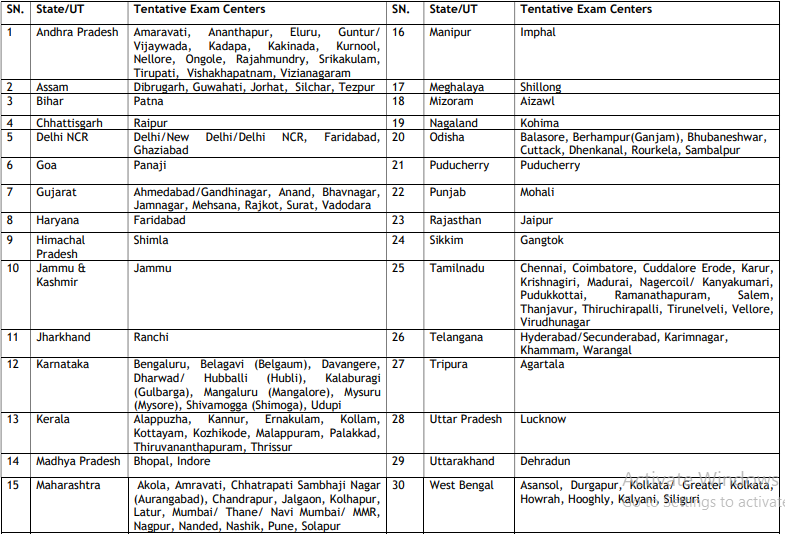

EXAMINATION CENTRES; Find out the centres nearest to you city.

LOCAL BANK OFFICER JOB PROFILE

- Provide assistance to clients with banking transactions, account management, and queries, ensuring high-quality service.

- Oversee account openings, closures, and maintenance, and manage customer documentation and compliance.

- Evaluate and process loan applications, including credit assessments and approvals.

- Supervise daily branch operations, including cash handling, record-keeping, and adherence to banking regulations.

- Promote bank products and services, achieving sales targets and enhancing customer relationship