Jindal Steel and Power wins Platinum Award for CSR Excellence

Sensex Stages Dramatic 1,400-Point Brings Relief to wary Investors

OpenAI CEO Sam Altman likely to visit India on Feb 5

No Katni Chhatni on record: Know here how the Bhadrak Collector unearthed the trick in disguise

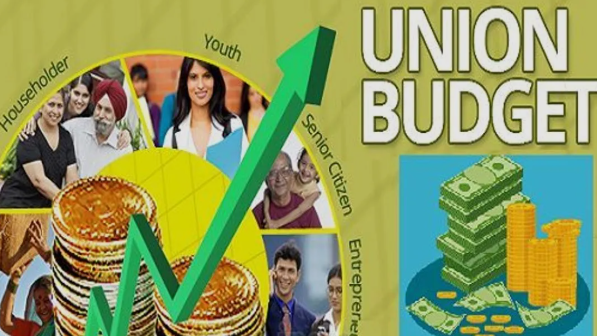

Budget 2025-26: Tax relief for 5.65 crore taxpayers

MCL unveils logo for March 2 Coal India Bhubaneswar Half-Marathon

GAIL increases start-up corpus fund to Rs 500 crore to boost innovation and entrepreneurship

Odisha CM thanks PM Narendra Modi and FM Sitharaman for introducing Zero Tax regime

Union Budget 2025: FM Nirmala Sitharaman announces basic customs duty exemption for 36 life-saving drugs

Union Budget 2025: ID cards & registration on e-Shram portal for 1 cr gig workers, announces FM Nirmala Sitharaman

Union Budget 2025: New UDAN scheme set to boost regional connectivity

India's path to 'Viksit Bharat': 8% growth needed for next two decades, says Economic Survey

Union Budget 2025: 10 Key Points You Cannot Miss From India's Annual Financial Blueprint

Paradeep Phosphates Ltd. Invests Rs 4,000 Crore in Odisha, Boosting Fertilizer Production and Agricultural Growth

India witnesses increase in gold price, check details

Union Fin Min Niramala Sithraman will increase PM KISAN to Rs 8k in Union Budget 2025; READ the fine print! EXCLUSIVE

Startup Odisha Paves the Way for a Thriving Innovation Hub at Utkarsh Conclave 2025

GAIL reports highest-ever nine-month PAT of Rs. 9,263 crores for FY 2024-25

Budget 2025: Will the government reduce personal income tax; know details

Odisha receives Rs 20,900 cr investment intent in IT/ITeS, electronics, semiconductors sectors